Much time has passed since Economics 101 thankfully. I was smoking a lot of bad weed in 1973, listening to some pretty horrible music, and wearing my hair so long that I had to smother it with hair spray to keep it in place on Saturday night. After a night of too many tequila shots and cigarettes, my curls went up in flames that year.

With that in mind, here’s my very hazy sophomoric takeaway on economics: there is some kind of intense and meaningful relationship between employment and inflation. That relationship involved something called the Phillips Curve, which wasn’t exactly the same thing as Elizabeth Nelson’s curves which I also studied intently that year.

Our classroom discussion of inflation and unemployment led to serious topics like the Bretton Woods Agreement, and the money supply. I had skied Bretton Woods, and my money supply was perpetually low, so I paid strict attention to this textbook lesson. What follows is a summary of all that I remember, plus the little that I have learned about economics, what Thomas Carlyle called “the dismal science”, since.

At the urging of my professor, who thought I had some talent in this area, I did write a short paper on the topic in order to achieve a grade of A for the course. I recall that my general thesis was inflation rises when unemployment goes down and vice versa. I was pretty certain of that. I regurgitated back everything that I had read which was, I had learned by then, the best way to succeed in college.

So, it was a big deal a few years later in the seventies when “stagflation” (high unemployment and high inflation) called into question this economic theory that I parroted. People were arguing about it all the time, even if they were not economists. A lot of what we thought we knew about money was called into question and could not be explained, which is very difficult for college students and their beloved professors, to accept.

I was graduating from college in the midst of this debacle, and stagflation definitely influenced my decision to seek an advanced degree. The solution to my lack of job prospects was more knowledge! Truth is that there were not a lot of job opportunities available at the time, so I went back to school, taught, pounded nails, and did other odd jobs in order to survive. Barely. Living on the seacoast of New Hampshire, I harvested a ton of mussels to supplement my diet of frozen tv dinners.

That was nearly fifty years ago, but it seems like just yesterday to me today. That’s because, and many have noted this, the current economic climate feels just like that period of time, way back when. High interest rates, inflation, poor job market, and lots of talk about crime. Same old same old political vitriol as well; no need to rehash. This was when cable news channels, spin rooms, echo chambers, and hit pieces all got their dubious start.

It was different in the sense however, that many people were actually scared by and afraid of what might happen next; the end of the seventies was a highly anxious period in American history. The cold war was still a hot topic, we had just realized that America was hated in Iran and throughout the Muslim world, and our gas guzzling cars were running on fumes, and we had to wait in line to fill them up. To add insult to injury, we had to drive fifty-five by order of Uncle Sam; more time to worry.

There is one big difference between then and now, however. There is even less trust in government today than during the end of the Carter presidency and no one seems surprised by the failures of our institutions anymore. Plus, there is medical marihuana, the internet, social media, and Tik Tok to entertain and keep the masses occupied.

The latest downward revision of the job numbers from 2024 is exhibit A in my case. Biden touted his “job creation” numbers as his top achievement while in office; turns out, after revisions, that this claim was bogus. The reported growth was fiction and few in the media seemed to care that the government was spending six dollars for every one dollar of GPD growth. As if this didn’t matter one bit to our deficit spending.

Forget about the fact that millions of the jobs that he created were just people coming back into the workforce after the government shut everything down due to Covid in the first place. Don’t be concerned that the bulk of the new jobs created during the Biden presidency came from the government sector. Just this past month we have learned that much of our understanding of employment is based upon Current Population Surveys and not on real facts and data at all. Who knew?

Suddenly it appears as though the Fed has been keeping interest rates high due to faulty information and poor data. The situation has gotten so bad, it has actually forced reporters to investigate and reveal to the public how employment data and job numbers really get manufactured. In other words, do their journalistic jobs. Suffice it to say that the methodology of the Bureau of Labor Statistics makes sausage making look like a pastry dish from a fancy Pampered Chef gizmo.

That is water over the dam as people like to say, and the presidential election is in the rear-view window. This is on Donald J. Trump now; this is his economy to deal with. What matters about the situation that we find ourselves in today is that we are experiencing stagflation again and we did not even know it. It seems to have snuck up on us— coming out of nowhere— taken us by surprise. That should not have happened with all of the economists in this country.

Some of us felt it; at least those of us old enough to remember the seventies. The signs were everywhere. Sure, there have been economic downturns and plenty of setbacks and recessions over the last half century, but there is nothing more demoralizing than having to worry about rising prices and losing your job at the same time. It is such a serious economic woe that economists and the reporters who cover economic issues have a term of endearment for it: “double whammy.”

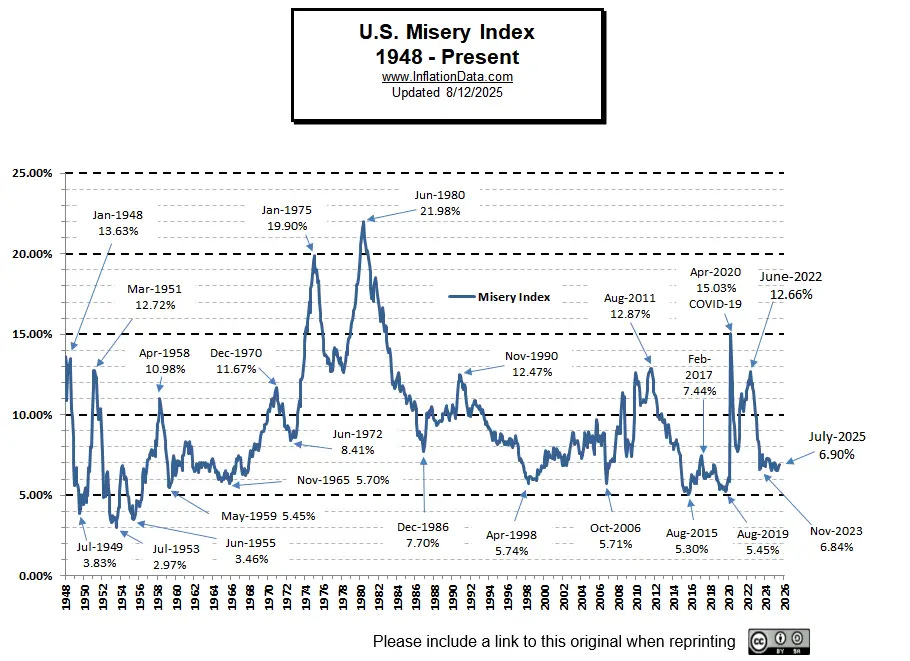

That double whammy phenomenon gave rise to the Misery Index which is a simple calculation of inflation plus unemployment. It reached a high of 22 in June of 1980 and was at an all-time low of 3 the year that I was born which was 1953. Before hitting thirty, I had seen the best and worst of what America has to offer. Like I said, my head was spinning and not just because I had spent time in my formative years under a disco ball.

“Some economists, such as Hooi Hooi Lean, posit that the components of the Misery Index drive the crime rate to a degree. Using data from 1960 to 2005, they have found that the Misery Index and the crime rate correlate strongly and that the Misery Index seems to lead the crime rate by a year or so.” That’s from Wikipedia so it must be true. We tend to talk more about crime when things get really tough like right now because crime fills a void that gets created when people do not have enough. Too little to go around.

Back in the seventies, artificial intelligence was the subject of science fiction, but today it is a real threat to employment. The whole concept should be fueling anxiety in the workplace, especially because so much money seems to be getting made in the markets right now, betting on AI. But it is not. I suspect that this has to do with the fact that many employees are cleverly using AI to create work for themselves and shareholders have not picked up on the ruse yet. They are too busy making money, but that will not last forever.

Middle management jobs, the staple of the American economy for the past twenty years, are increasingly viewed as an endangered species. Large language models and generative AI will, the theory goes, automate and streamline every fortune 500 company and eliminate a sizeable percentage of “good jobs”. Profits will go up, thus the current optimism with stocks. What goes up, must come down. We are due for a correction soon.

The concept of “good jobs” reminds me of a bit that the comedian Dusty Slay does on “good money”. There are all kinds of jobs, just like there are all kinds of money. A good job is how you choose to define it. This explains the phenomenon of the popular Netflix show, Severance, which is a show about good jobs that turn bad. It’s all about perspective.

Dusty was a pesticide salesperson before he achieved some small amount of success in comedy, so he has a lot of credibility with me. Describing horrible jobs has morphed into an internet contest in which cynical and jaundiced employees explain what they do. Here’s a winning entry if ever I have heard one: “I answer the phone and then tell people I’m not qualified and can’t help them.”

But it does seem crazy to me that something as impactful as interest rates can be based upon fiction and campaign slogans. It’s insane that our Bureau of Labor Statistics and our Fed— the people who control the supply of money— have gotten it so wrong when many of us felt so certain that we had been here before. Deja Vu all over again. Stagflation sucked in 1978 and it sucks again today.

I would feel so much better if I just heard more people admit that they do not know what the hell is going on. Would we not be better off, if our government occasionally told us that they screwed up and now we have to pivot? Why are so many digging their heels in and shutting down intelligent discourse? Everyone has to be right all the time; what’s up with that?

3rd Quarter GDP growth is currently estimated to be 3.1% so we are not in a recession thankfully. The trade deficit has come down from all-time highs thanks to Trump’s tariff revenues. The jury is still out on where inflation and employment numbers are headed, so we are treading water. So, what are the economists missing?

Once again, just as it was in the seventies, the focus in on high interest rates that are penalizing everyone except those with piles of cash. Credit, for better or worse, is the backbone of the American economy, and it is nearly dead. Consumers are tapped out, same with the US government. You can’t get blood from a stone.

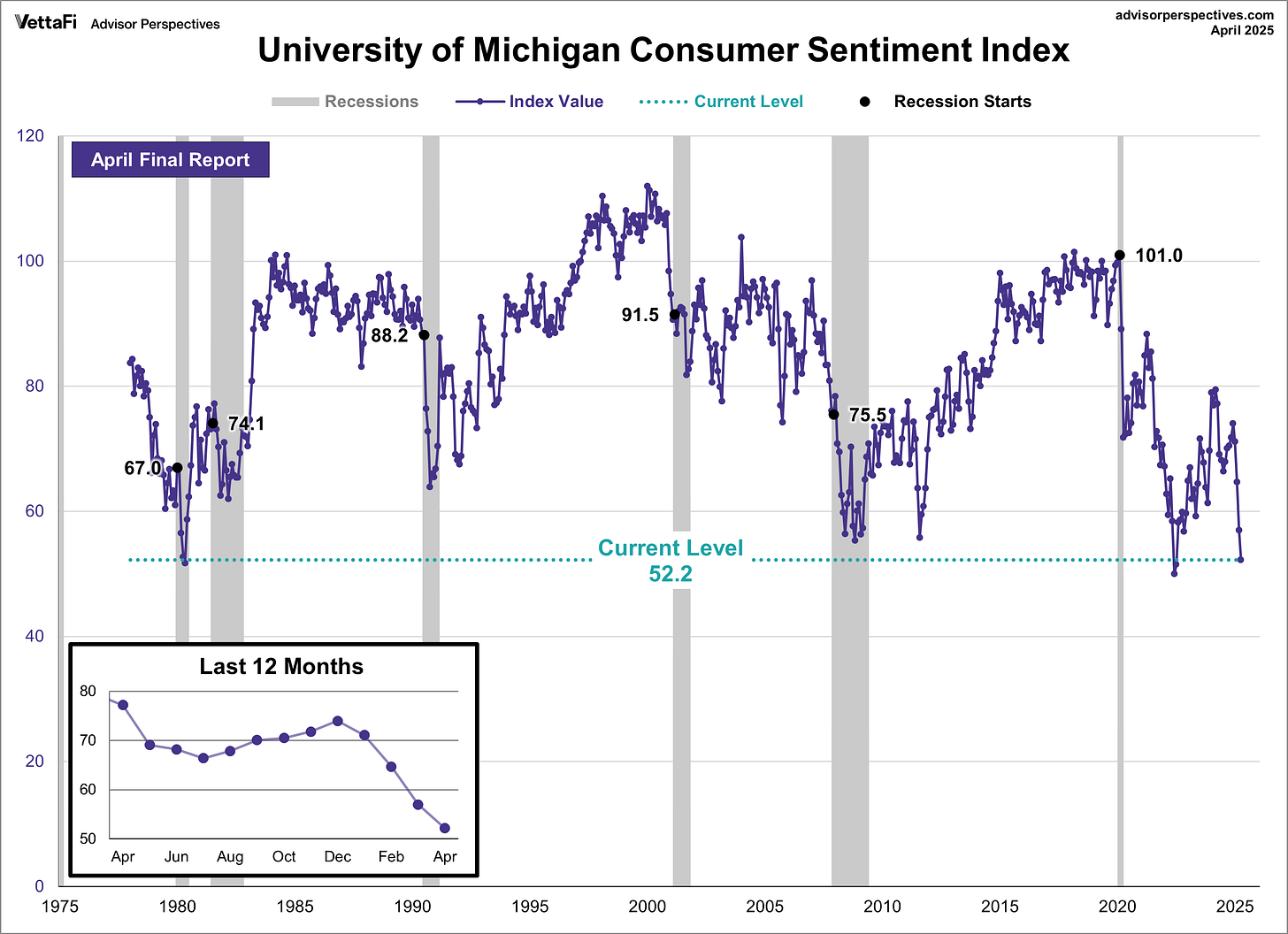

To make matters worse, the housing market has stalled big time, car sales are down, and loan defaults are going through the roof. These factors have a psychological effect on consumers as well. Hopelessness for the young who have just entered the job market and fear for those who feel trapped by high debt payments that they took on in better circumstances. These are not good times to be retired and living on a small, fixed income either.

Is it any wonder then that we are witnessing a meltdown in the media over current events like crime in our cities, political violence, and mass shootings. There is no agreement on the causes, each side clings to its mantra. We argue amongst ourselves whether these issues are problems at all. Cite alternative statistics to counter each other’s specious logic. Our two-party political system in the United States has painted us into a difficult and dark corner.

“At 33, I knew everything. At 69, I know something much more important” the novelist Anne Lamont wrote in an opinion column for the Washington Post a few years ago. She was talking about the unknown and our willingness to accept it. A resident of New Mexico, she describes what we do not know as a vast desert landscape where small flowers bloom for just an instant after a rain and then disappear leaving us speechless. The unknown is a portal to the richness within us she thinks. I agree.

I do not know anything about economics, and I am not afraid to admit that. I can regurgitate what I read and digest, but it’s just vomit obviously. You should not pay attention to what I have to say. It is okay to pay attention to what I feel, however. Humility is the light of understanding the adage goes. “A true genius admits that he/she knows nothing.” Einstein wrote. With AI at our side, I wonder if we will ever celebrate the mind of a genius like Einstein again.

It sure feels like the American economy is in a bad place again just like it was in 1979. In spite of what Trump says, we should not take solace from the fact that we are better off than France, Canada, or China for that matter. There is suffering everywhere, just look around and you can see it. What we need is a good dose of humility and more economists to admit that we have no clue as to what we are doing. We could also use some fresh, accurate data. The dismal science has failed us dismally.

I know that I would feel better about our current situation if I heard a government official answer a difficult question this way for once: “I don’t know; I’ll do some research and get back to you.” But that is not likely to happen any time soon. The cynic in me predicts that, having learned nothing from our past, we are bound to relive a very difficult period in our recent history that will be very painful to us all.

And finally, we should all hope that the Trump Administration can in, Charlie Kirk’s words, PROVE ME WRONG. You don’t need to be an economist to know that stagflation is the worst of all economic evils. Stagflation in the 1970s led to a destabilized economy, one in which individuals and families saw their quality-of-life decline. I would prefer not to see it again in my lifetime.