It is that time of year again. Assessment time. Don’t know about you, but I cannot get through the New Year without ruminating on the recent past, before moving on to the near future and what is directly ahead of me. This year has been a very difficult transition as I have had to digest concerning news coming from the three last companies that I worked for: Atlantic Broadband (ABB), now rebranded as Breezeline, New Wave Communicatons (a Division of Cable One), and Logix Fiber Networks a company that I led for the first several years of existence. These three companies are under a lot of stress right now; the future does not look good for any of these businesses

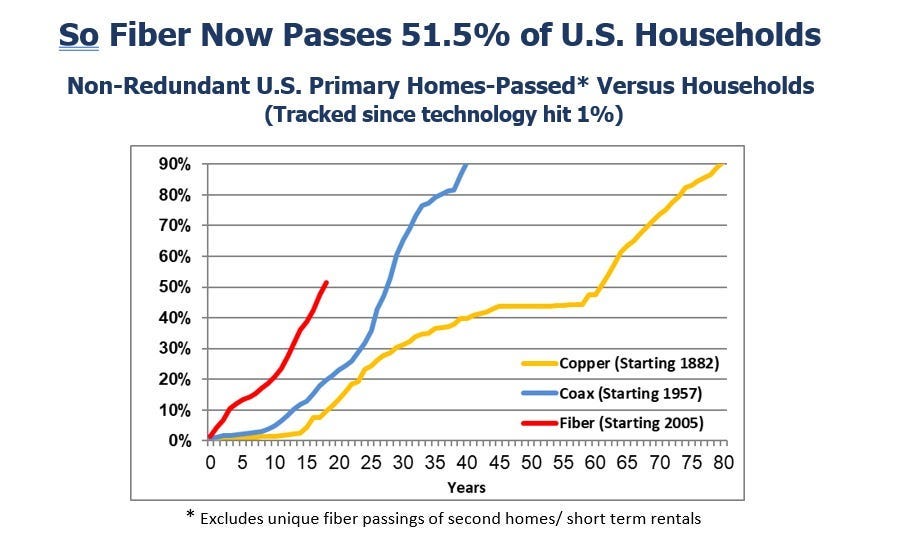

I still have friends and associates at all three companies. The last thing that you want to hear about before the holidays is layoffs and downsizing. Unfortunately, all three companies are feeling the pinch of competition and the impacts of an economy that is crimping the style of small businesses and consumers. For the cable industry, the shift in the way we watch video has been a death knell. In the strange world of telecommunications, the way that consumers and businesses talk to one another is shifting even faster. And then there is the business of the internet; well, let’s just say that things are changing at the speed of light. Fiber that is; fiber is going in everywhere.

In the case of Atlantic Broadband (ABB), my sense is that Cogeco, a Canadian Cable Operator that purchased the company in 2013, doubled down on the US cable business at exactly the wrong moment in time. After closing on ABB, Cogeco purchased Metrocast in 2018 and then a division of WOW in 2021— at the height of cable valuations. They tripled their market size and nearly tripled their total investment in the cable industry in the USA. The Metrocast systems were a good fit; the WOW properties were not. The WOW systems in Cleveland and in Columbus have been hemorrhaging customers since the pandemic. The results in Ohio are dragging the Canadian cable operator down. Meanwhile the remaining WOW assets have increased in value due to the smart divestiture of those same cable systems.

The results at Cable One, the acquiror of New Wave, are very similar but for a different set of reasons. New Wave was a good fit for Cable One, serving rural customers in tier II and tier III markets in middle America. For a minute, Cable One was envied by all in the industry, and a darling on Wall St, for having chosen a path that seemed to avoid competition. Unfortunately, what they did not see coming was the investment that the Biden administration was going to make in rural broadband. One FCC initiative, the Rural Digital Opportunity Fund, or RDOF, injected billions of dollars in funding to support the construction and operation of rural broadband networks. The RDOF provided $20.4 billion in funding to accelerate the growth of fiber networks in out of the way places, the kinds of places that New Wave Communications and Cable One serves.

A lot of that money is going to municipal cable operators, electric cooperatives, and rural telephone operators that are using these funds to build out fiber networks in their geographical footprints. In addition to the RDOF money that I just mentioned, there is another $42B of Broadband Equity, Access, and Deployment money (BEAD money) waiting in the wings to fund even more unprofitable projects. There are thousands of these operations out there in small town America, and they are building out state of the art fiber networks in places that struggle to get cell phone coverage. This “state sponsored” competition is hurting Cable One because these networks are providing more and faster bandwidth at lower costs. These operations are chipping away at the edges of Cable One’s most rural operations.

Cable One may just be the most undervalued stock on the market with just a $2B market cap today. Cable One is about 30% larger in size than Cogeco’s Breezeline into which the Canadian have invested $3.6B. Ouch! Today, Breezeline might be worth a little more than the Cogeco paid for ABB back in 2013. The new CFO at Cogeco suggested that they may sell off the US assets by region, my best guess is that they might fetch $1.5B in total. That would imply a staggering loss of two billion or so in market value for the Canadian operator. But do not invest in Cable One because I say so!

As jarring as that math is, when you look at the stock history of Cable One you quickly realize that the market capitalization of the traditional cable MSO is now just a fraction of the $10B that the company was worth at the beginning of the pandemic. The company stock has lost 80% of its value over the last five years, more than $7B in enterprise value is gone. These market value losses are much worse than the industry average which is more or less determined by Comcast and Charter. Those two operators have their challenges, but it is presumed that they are in a better position to weather the storm which is intensifying.

Cable operators have not been valued purely on cable subscriptions since Obama was in office. It is all about broadband subscriptions these days. Operators hardly report on video customers and revenues because they no longer exist, and the video business is barely profitable at this point. Unfortunately, the same is true for the revenues from landline telephone service which used to be robust for MSO operators. Most cable companies have a wireless play which is filling in some of the void. However, the cell business is basically the resale model for cable operators and therefore does not add much to the gross margin. The service is seen more as a package add on to broadband in order to retain customers.

The problem that cable operators face is a mature broadband market that peaked at the outset of Covid. Since 2020 the total number of wireline broadband customers has not increased and at the same time there have been a host of new entrants into the market including fiber to the home overbuilders like Google, Verizon, and Metronet, fixed wireless operators like T-Mobile and Starry, and satellite providers like Starlink. All vying for the same broadband consumers. Due to the increased competition, the price of internet has not increased; in fact, in these days of high inflation, internet service has arguably decreased in cost, bucking all kinds of trends in household expenses.

Logix Fiber Networks focuses on commercial broadband services and has built its networks into office buildings in large metro areas in Texas. The company competes against the large national telecom providers like AT&T and Verizon, as well as the regional telecom players like Conterra, Lumen, Century Link. Of course, in each market that LOGIX served there was typically an MSO provider like Comcast or Spectrum present in the buildings as well.

I was attracted to the business model through my experiences with commercial enterprise business sales at Atlantic Broadband and at New Wave communications. The sale of circuits, bandwidth, and data center access to regional businesses is extremely profitable. The market is always growing. The competition is fierce, but the rewards are high. If you have a great fiber network, like the one that we had at LOGIX, you can be competitive with a fraction of the size as the big players like AT&T and Verizon as long as your network is robust and diversified and is connected to all the right real estate.

The opportunity was huge in Texas, and we acquired Alpheus Communications in 2017 which was a similar BTB ISP company working in the same markets: Houston, Dallas, Austin, and San Antonio. Unfortunately for us, even after a successful integration of the two companies, the “burn rate” at Alpheus could not be overcome. In short, there were too many deals that were underwater at Alpheus, without any gross profit at all, and our attempts at eliminating our contracted circuit expense was nullified, mostly by our largest competitor AT&T. Though we quickly closed down duplicitous offices and hubs, we were unable to significantly reduce the cost of goods sold expense that went with most of the resold circuits.

We paid too much money for a company that had a burn rate of $1M a month and no budget for “maintenance” capital. There was a failure in due diligence prior to the acquisition which was conducted by our sponsors at Astra Capital Management. Nearly every enterprise customer account had a “leased” component to their service. A lot of these leased circuits were delivered over the plain old copper network. These connections proved to be the weakest link in our service. Worse, the network that we bought at Alpheus was sonnet based, and we had to upgrade it immediately to process light and waves which was costly, but necessary to take advantage of the fiber.

Then Covid hit and the world of commercial real estate changed as employees began to work from home. Overnight the focus of business changed from the office to the home office. I was not at LOGIX by this point, but I can only imagine what it was like to witness the abrupt deterioration of thousands of enterprise business deals that had to be undone. Overnight, the workforce needs changed, and it was all about work from home applications, SD-WAN, and VPNs. The core business suffered, and the revenues fell. In 2023, a full four years after I was forced out, I discovered that the LOGIX customer base was much smaller, and revenues had fallen by about 40%.

But it was the debt that has LOGIX on the ropes now. The company has hired a restructuring expert and laid off most of the management team as well as 10% of the workforce. The company is busy negotiating short term forbearance and a longer-term financing option. That may or may not happen. There is little or no equity in

the company in spite of owning an excellent fiber network. On the basis of its fiber routes, the assets are worth about $400M (7,000 route miles at $60K per mile) but LOGIX will not fetch that much. It is hard to believe that the company once had an enterprise value of $750M or so, based upon a multiple of 12X Management adjusted EBITDA of $60M. There is nothing left there for shareholders except a disappointing fire sale.

That is about as much rumination as I can handle! Is there a common thread here that I can use to sew this tattered, old coat back together? I think that there is. First, the cable industry is officially dead, and the streaming services have the wind at their backs as Cable, Direct TV, and DISH all falter and expire. NFL playoff football is now live streamed! There will never be an independent “video provider” ever again. It is simply not economically feasible which is why you see DISH selling itself for an assumption of debt and $1 and other valuable considerations. I realize that I have not said one thing there that you did not already know.

Second, broadband is a commodity, and the costs are not increasing due to the amount of competition in this market and the amount of government money flowing into the space. You have the fixed wireless providers expanding and the satellite providers getting stronger. Soon enough Amazon will have its own satellite internet service which will compete with Musk’s Starlink. The US government will be investing in rural fiber networks and private equity will back pure fiber to the home plays. The bottom line is that the cost of the internet will be around a hundred bucks a month for years to come. Yeah!

Acquisitions are tough and another thing that these three broadband companies have in common, Cable One, Breezeline, and LOGIX Fiber Networks, is that they made questionable purchases at pricey multiples. Buying at the height of a frothy market as Breezeline did with the WOW systems. Overpaying for Alpheus as LOGIX did without conducting rigorous due diligence. Sometimes an acquisition will just increase your exposure to disastrous market trends, as the purchase of NewWave did to Cable One.

But that is not what I am thinking about this morning as I wrap up this piece and put 2024 in the past. What I am ruminating on is the loss of jobs and the lost opportunities that have impacted so many that I worked with in the past. Displaced employees, those that will never have such a good job again. It is a shame. I am certainly not suggesting that these are issues that I could have avoided if at the helm. I am not so vain as to say that my crystal ball was any more powerful than anyone else’s. What I have written about in this post is all hindsight which we all know is 20/20 vision.

But it is sad to see so many younger people that I knew and worked with, struggling with these economic conditions. And it is a good reminder that the stock market and our current economy has been buoyed by 5-7 tech stocks, mainly with familiar brand names like Amazon, Apple, Google, Microsoft, and Meta. You know the LOGOS on the planes that are flying to Mar a Lago these days. You may be streaming playoff football this year rather than watching it as you used to on cable. You may be spending just about the same for your entertainment these days as you did before? Are you? You better check.

And it may just be that you are not paying more for your internet connection. I sure hope not, given all of the alternatives. To me it demonstrates the ultimate power of policy in the US economy. That is why Mark Zuckerburg is yukking it up with a person who he likely thinks sucks. That is why all the tech titans are paying homage to the orange man in Florida. Because policy does matter and let’s face it folks, these tech moguls have had a leg up on all of the competition since around 2010. When this chapter of history gets written, years in the future, it will note that the original net neutrality debate in America was one that should have gone on a little longer and with a little more input. At least a vote. That is what I think anyway.

Capitalism is fierce and there are winners and losers. In every business transaction there are gains and then there are losses, puts and calls, credits and debits. Our economic system has the same kinds of checks and balances as our political system. The reversal on the Chevron decision is in place now which would have made Jeff Bezos and Reed Hastings of Netflix work harder for a leg up on the competition, so I take comfort in saying that their day will come. Maybe. They wield so much power in our markets today, it is hard to imagine life, as we know it, without them. But I try to do that every waking hour of the day.

We have an open and free internet allowing for the fair flow of video and content meant to keep us occupied and entertained. But there is a cost to that which was not contemplated at the time by our regulators at the SEC or by our political leaders. The tech giants have decimated an entire industry of cable and telecom. The tech industry is now responsible for the creation and the distribution of nearly all of the programming and content available to the masses. How did this happen when 3o years ago as newspaper outlet could not own more than one television station within the market it served?

Actually, the net neutrality ruling was made at the FCC and not by congress where it would have required votes. The decision was made by an administration and a regulatory agency that anointed the people who made our computers and software into the purveyors of content. Within a few years, we were streaming everything; having all of our questions answered by our phones! Now with the power of AI they are telling us how to think! The Democrat party let the genie out of the bottle, and everything changed with regard to the way that we view and perceive things. Forever, if there is such a thing.