Easy Come, Easy Go

Working in Vain Part II

In one of my most widely read posts over that past year, I perseverated over the recent, poor financial performance of the last three companies that I worked for: Atlantic Broadband (now branded Breezeline), NewWave Communications (now called Sparklight), and LOGIX Fiber Networks. That was the name that I came up with for the combined Logix and Alpheus Communications back in 2017. Two Legacy Incumbent local exchange carriers, (IlECS) from the days after the breakup of AT&T in 1986; both had dubious reputations.

It’s tough to reach this stage in life and realize that the companies and people that you left behind at your last three career stops are in trouble, and that many of the employees and good people that you worked with would be let go due to market forces and through layoffs. I titled the piece Working in Vain. I don’t typically write about depressing topics, but this story had to be told. And the final chapter has not been written yet, so you’ll have to stay tuned for an update in another six months or so.

Working in Vain

It is that time of year again. Assessment time. Don’t know about you, but I cannot get through the New Year without ruminating on the recent past, before moving on to the near future and what is directly ahead of me. This year has been a very difficult transition as I have had to digest concerning news coming from the three last companies that I worke…

Now I have an update on the situation and it’s not too pretty. In fact, the news is worse than it was six months ago, and it has nothing to do with tariffs! Where do I start? How about by talking about the Charter/Cox merger first? Charter is acquiring Cox at an enterprise value to 2025 estimated EBITDA multiples of 6.4x and less than 6x reflecting cost synergies and tax benefits to both parties. And important to note, Cox is exchanging for equity in the new company. It’s receiving $17.9 billion in convertible preferred and partnership units, plus only $4 billion in cash and the assumption of $12.6 billion in debt. Cox will own 23% of the equity once the units are converted to stock.

The only people in the cable industry celebrating this deal are the good folks who run Spectrum, the second largest cable MSO in the country behind Comcast, soon to be numero uno. At first blush, they seem to be purchasing Cox for a song. However, most in the industry see this deal for what it really is, a total capitulation by the owners of COX, a recognition that after forty years, they no longer have the horsepower and capacity to manage a cable operation nearly big enough to drag the entire Atlanta based, family-owned Cox business empire down, and the assumption of enough debt to sink Spectrum all over again.

My personal view is that the Robbins family has finally seen the light and come to the same conclusion that I have, that the cable industry is dead. Thier best bet is to trust what little they have left in the business to others for safe keeping and then cross their fingers and hope for the best. Wireless and satellite service is the future. Focus on their other business units. The Cox shareholders will start selling their Spectrum stock as soon as they can; that’s my prediction. Notably Comcast and Cox partnered on a lot of activities prior to this announcement; apparently, the cable giant was not interested in adding to their problems.

Charter, on the other hand, is taking a huge risk with the assumption of $12B in debt and the future operations of the Cox Networks, which are hybrid fiber & coax like their own. It will cost Spectrum a fortune to upgrade these urban systems. I noticed in the press release on the deal, that Charter refers to itself as a Wireless Broadband provider now. That is a nod to the success that they have had rolling out a wireless product which has transformed their business model. With luck that success will continue with the Cox systems.

By contrast Cox had been struggling with its rollout and not seeing the same kind of results with wireless service. The problem for Cox is a poor brand image in the small cities that they serve like Providence RI, Las Vegas, New Orleans, and Phoenix proper and a mobile product that has lower customer satisfaction than Mint Mobile. You have to subscribe to their broadband service to buy the wireless service and with a dwindling customer base, that’s not a great marketing strategy.

This is a fascinating merger to study. On the one hand, the combined company will be abandoning the old name Charter Communications that dates back 30 years to a time when Jerry Kent and a group of investors out of St. Louis Missouri combined a number of small cable systems into a Mutiple System Operator (“MSO”) operation and formed Cencom, the company that owned Charter. That company went bankrupt in 2009 and restructured its debt. That paved the way for a purchase of half of the cable assets of Time Warner.

Now the combined operation will retain the new Spectrum moniker, will continue to market under that brand name, and will drop Charter and continue doing business as Cox Communications, the minority partner in the new entity. Didn’t see that coming. The Robbins family, the owners of all Cox enterprises, have big egos. The executive management team had no loyalty to the legacy name Charter which has seen its ups and downs over the years.

The egos of the owners of Cogeco are not so large as the Atlanta based Robbins family, but they have been brutally bruised as well in a Canadian sort of way. They invested billions of dollars in the US cable industry and for a minute that looked like sheer genius. As it turns out they bought in at exactly the wrong moment in time. Soon enough they will have to pay the price. They could lose 3/4 of what they put into this venture. Depending upon the state of relations between Canada and the USA and in light of exchange rates, the damage could be worse. It will be at least 2 billion dollars of enterprise value gone from Cogeco. Much worse than what they lost when thy invested in another failed cable venture in Portugal 15 years ago. They should stick to what they know best which is Canada!

The burning question is this: are the many small pieces of their American division of Cogeco worth more than the whole entity called Breezeline? With cable operations now selling for a fraction of what Cogeco paid, it really doesn’t matter. It’s just a matter of how much the Canadian cable operator will lose at this point. The real question is just how fast will the Canadians want to exit this market? Based upon my interactions with the company over the past year, I would say that they want out now. They have let go or fired almost all of their US based employees. They are trying to run an American cable operation of nearly one million customers from Montreal. Its not working either.

Is there a market for these small, rural hybrid fiber and coax networks? There are still a number of independent, well run cable operators out there like Armstrong, Service Electric, Blue Ridge, TDS, Shentel, and Midco who could take a run at some of the former Atlantic Broadband assets. They could buy them for fire sale prices and fold them into highly successful operations. Or perhaps a new management team will find a sponsor and purchase the brand or what is left of Breezeline? That seems less likely: are there private equity investors with an appetite for hybrid fiber/coax assets? I don’t think so; I don’t see that happening.

There is a small chance that some aggressive, private equity backed fixed wireless internet providers will take a close look at these assets. However, it does not seem likely that anyone larger will come along like TMobile or AT&T. These assets are practically off the grid and in remote markets that would interest no national wireless providers like Verizon.

Some of the Cogeco cable assets on the East Coast may garner more interest. Comcast could fold in the New England cable systems very easily including the Miami Beach system which is adjacent to their operations. Getting rid of the troublesome Ohio assets purchased from WOW a few years ago will not be so easy. Breezeline overpaid for the assets which have dragged the company’s performance down. They are a mess.

It goes without saying that the news of the merger of the #2 and #3 Multiple System Operators (MSOs) was not celebrated by the rest of the cable industry and that the well-publicized problems at Cogeco are front and center. At Cable One, which was already overwhelmed by its own bad news, the situation is dire. After disappointing year end results, the Phoenix based cable operator had to eliminate its dividend. The stock fell 109 points (about 45%) in one day to $150 per share. Ouch! The market cap sunk to less than a billion dollars or roughly 12% of its value just 3 years ago at the height of covid which was great for broadband, cable, and home internet use. The company could be bought today for about $1Billion dollars. Astonishing.

Cable One is suffering from intense competition from small fiber to the home overbuilders that are nipping away at the fringes of its cable operations. However, some of the wounds are self-inflicted. The cable operator has not been aggressive enough adopting new technology and the MSO delayed exercising on synergies from the several acquisitions that it made between 2014 and 2022. It is shame because they may no longer have the means to consummate the deal that they made to purchase the rest of Vyve Cable. That deal should have been done by now and Cable One has less than half the cash necessary to close.

I know Julie Laulis over at Cable One and I worked with COO Ken Johnson at NewWave Communications which CableOne purchased in 2016. My heart goes out to them; two of the nicest people in the Cable industry and really solid operators. In some ways the market forces have buffered Cable One more so than other MSOs but to some extent management has brought the problems on themselves by not integrating its divisions quickly enough and through complacency. To the outside world they seem to be paralyzed now by indecision and poorly executed half steps. They missed an opportunity years ago to invest in their operations.

The situation at Cable One reminds me of my final days at LOGIX Fiber Networks in the Spring of 2019. That’s when I realized, much to my horror, that there was not enough automation in our provisioning processes and that customers expected a more robust response from the company to their needs for circuits and bandwidth. It is a highly competitive business today. I conducted an independent study on the provisioning process and the total time from the signing of the sales order to the activation of the circuit in our billing system and the process took nearly six months on average. Meanwhile we were advertising and promising sixty days from order to service. Customers hated us and our brand was suffering!

The fall out, cancellation rate on orders was as high as 15% in many months. The problem was easily to identify: zero automation; every step in the process was done by hand with a ticket. A reliance on third party providers. It was business the old-fashioned way: the way telecom worked until competition showed up. To make matters worse, much of our network was thirty years old. In truth it was a sonnet-based network, the network that we had purchased from Alpheus Communications, and there wasn’t anything we could do to upgrade it. Instead, we overlayed a Cienna, Ethernet Networks with next-generation optical-transmission equipment. Our plan was to serve future customers with this new optical network with enough intelligence to self-provision end users.

After we acquired Alpheus Communications, I learned that we were shedding customers on the legacy sonnet-based network at three times the rate that we were adding customers on the new network. This had the effect of doubling the churn rate from less than 2% per month to nearly 5%. Two years after consummating the acquisition of Alpheus, we were suddenly losing customers every month. Some of these customer losses were “bad business” (customers with a low profit), but the net effect proved to be negative to our business soon enough. The problem with our service is that we had many customers who had purchased the old sonnet-based system and the new optical network. We had to keep both running until we could serve every location.

I have spent an entire career working in recurring revenue businesses. Even today, working and advising at Adrentech, our business model is essentially subscription based: we write work orders that have monthly usage fees. The power of these models is predictability and stability. The recurring revenue means that the company is not over reliant on new sales and selling, which has a huge expense and distraction; this kind of business model allows management plenty of time to respond to negative market forces.

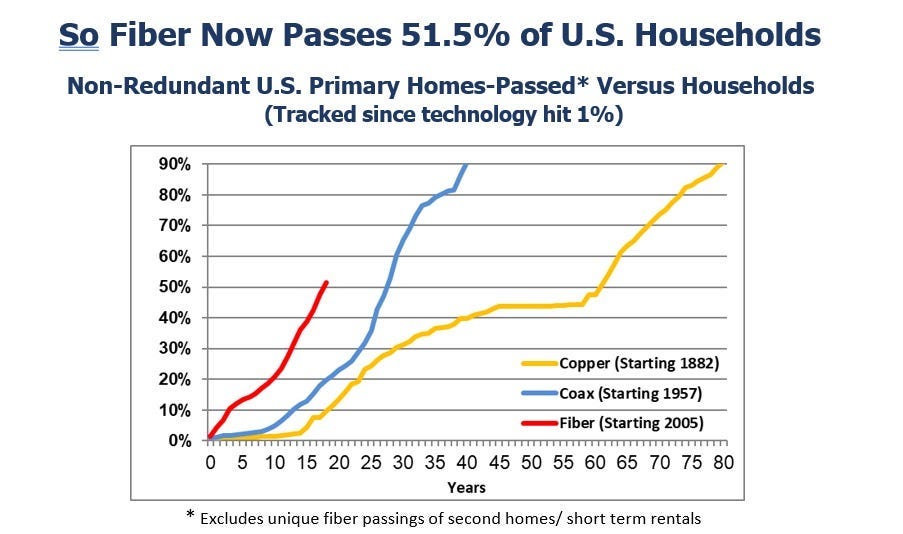

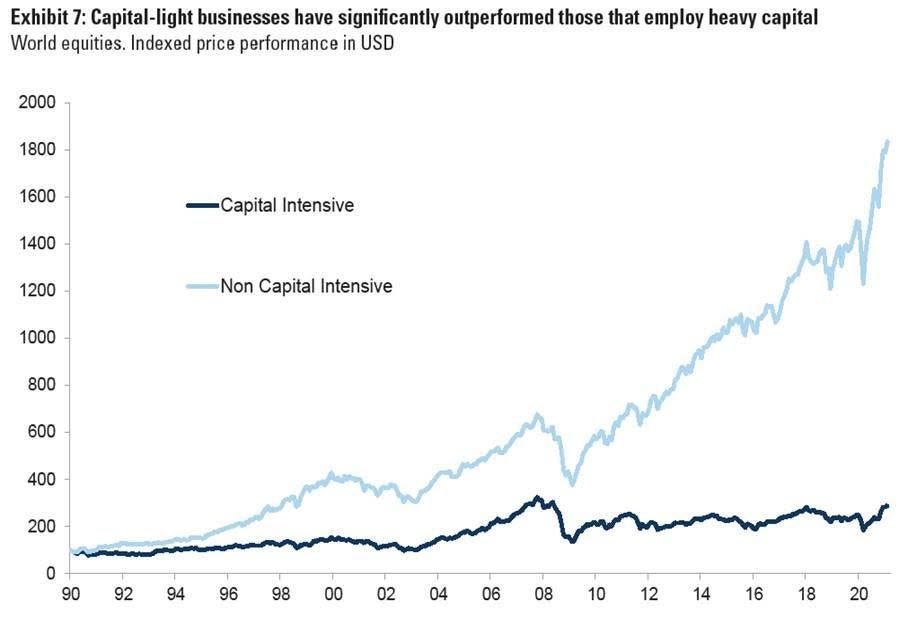

But there is a downside to these recurring revenue subscription-based business models like cable: they are capital intensive. Unlike the software business, these businesses require regular ongoing investment in order to keep pace with technology and to meet the need of fickle consumers who are always looking to buy the next best electronic solution. The capital costs of keeping pace with consumer technology is enormous unless you leapfrog to a fiber to the home solution. And when the product becomes a commodity, as broadband is today, there is not opportunity to raise rates. Your business is bound by the size of your network.

As a result of this phenonium, Cable One and Charter are among the most shorted stocks on the market today. The view on Comcast is becoming increasingly negative due to their public struggles and very public fight with the Trump administration. Brian Roberts image is taking a huge hit. The enormous loss in value of their programming services like MSNBC isn’t helping the matter.

The market forces working against them are so strong. A swing to the right politically. The dominance of Fox news. Government sponsored overbuilders, private equity backed overbuilders, fixes wireless operators, and low altitude satellite providers are all viable competitors at the moment until the MSOs migrate to Docsis 4.0. The cost will be significant and with a dwindling customer base, the payback will be uncertain. Comcast was wise to buy NBC/Parmount many years ago, but they will need to be a more aggressive streaming player soon if they want to stay in the game.

For what it is worth, I got my final annual report from LOGIX last week. Also, a 2024 K1 months after the IRS mandated deadline. This is to inform you that the shareholders have been wiped out!!!! In case you hadn’t figured this out months or years ago. About $135 million in equity down the drain. A lot of that money came from the middle east, the Kuwaiti retirement fund; the sponsors are lucky that they have all their digits, hands and feet!

In the first two years of operations, after we had successfully combined the two companies (Logix and Alpheus) and exercised on the projected synergy savings, our team has nearly doubled the stock price and the equity in the combined company was well over $200 million. Even if we had settled on a final price of 80% of our first bona fide offer, everyone would have done quite well on a very short investment.

My stake in the company could have been worth $10 million the day that we received a letter of interest for $900 million from a major infrastructure hedge fund. But those glory days are long gone. LOGIX was acquired by USB-O’Connor, its junior lender for $360 million at the end of Q1 2025; $200 million in cash (debt that was converted to preferred stock) and the assumption of $150 million in debt.

That’s about $70 million less than we raised to put the two companies together in 2017. Today the former owner, a private equity sponsor, retains a fractional $5 Million dollar interest in the enterprise after having lost a lot of their own money, plus a lot of other people’s money too.

As they say, easy come, easy go.